Elon Musk Income Taxes

- carmenjonze

- Posts: 9614

- Joined: Mon Oct 25, 2021 3:06 am

Re: Elon Musk Income Taxes

________________________________

The way to right wrongs is to

Shine the light of truth on them.

~ Ida B. Wells

________________________________

The way to right wrongs is to

Shine the light of truth on them.

~ Ida B. Wells

________________________________

Re: Elon Musk Income Taxes

It's because he really doesn't have a clue about history.

Re: Elon Musk Income Taxes

I mean, he's almost half right.

There were plenty of women in the workforce - anybody seen Mad Men? - they just had to deal with rabid sexism and harassment from their male bosses, and of course a gender pay gap way wider than it is today. And of course a strong as iron glass ceiling. Plus, of course, a culture that kept telling them they "really" "belonged" at home as happy homemakers, barefoot and pregnant. Depressed, ladies? Take valium.

The workforce had plenty of people of color, it's just the workplaces were often segregated and unfortunately so often were the labor unions. And then as now, they had their racial/minority pay gap/inequality. I don't mind when Reich and Krugman talk about this era, but this so-called golden age of shared prosperity wasn't shared equally by all.

There were plenty of women in the workforce - anybody seen Mad Men? - they just had to deal with rabid sexism and harassment from their male bosses, and of course a gender pay gap way wider than it is today. And of course a strong as iron glass ceiling. Plus, of course, a culture that kept telling them they "really" "belonged" at home as happy homemakers, barefoot and pregnant. Depressed, ladies? Take valium.

The workforce had plenty of people of color, it's just the workplaces were often segregated and unfortunately so often were the labor unions. And then as now, they had their racial/minority pay gap/inequality. I don't mind when Reich and Krugman talk about this era, but this so-called golden age of shared prosperity wasn't shared equally by all.

"Don't believe every quote attributed to people on the Internet" -- Abraham Lincoln

Re: Elon Musk Income Taxes

It certainly wasn't. And yes, the unions WERE segregated. Now, in Detroit, blacks did work in the auto plants, but in the dirtiest jobs. Same with the aircraft plants in Kansas.ProfX wrote: ↑Tue Dec 21, 2021 8:05 am I mean, he's almost half right.

There were plenty of women in the workforce - anybody seen Mad Men? - they just had to deal with rabid sexism and harassment from their male bosses, and of course a gender pay gap way wider than it is today. And of course a strong as iron glass ceiling. Plus, of course, a culture that kept telling them they "really" "belonged" at home as happy homemakers, barefoot and pregnant. Depressed, ladies? Take valium.

The workforce had plenty of people of color, it's just the workplaces were often segregated and unfortunately so often were the labor unions. And then as now, they had their racial/minority pay gap/inequality. I don't mind when Reich and Krugman talk about this era, but this so-called golden age of shared prosperity wasn't shared equally by all.

For years, my union excluded all the white men. Period. I'm not proud of that at all. The AFL was segregated, The AFL was dedicated to craft unionism, where only skilled workers could join. The CIO was NOT, they wanted to unionize all workers, such as unskilled or semiskilled workers. My union changed to integrate, and I AM proud that that demand for change came from the grass roots.

Of course, when the unions would strike, the companies would always hire blacks as strikebreakers. The companies used racism to divide the working class.

They still do. They have people like Glenn convinced that letting black people into colleges steal spots from white people, and that scares gullible whites.

- carmenjonze

- Posts: 9614

- Joined: Mon Oct 25, 2021 3:06 am

Re: Elon Musk Income Taxes

Workplaces were segregated by race and gender, and entire sectors were gendered.ProfX wrote: ↑Tue Dec 21, 2021 8:05 am I mean, he's almost half right.

There were plenty of women in the workforce - anybody seen Mad Men? - they just had to deal with rabid sexism and harassment from their male bosses, and of course a gender pay gap way wider than it is today. And of course a strong as iron glass ceiling. Plus, of course, a culture that kept telling them they "really" "belonged" at home as happy homemakers, barefoot and pregnant. Depressed, ladies? Take valium.

The workforce had plenty of people of color, it's just the workplaces were often segregated and unfortunately so often were the labor unions. And then as now, they had their racial/minority pay gap/inequality. I don't mind when Reich and Krugman talk about this era, but this so-called golden age of shared prosperity wasn't shared equally by all.

They still are. Domestics have always been entirely nonwhite and/or immigrant women, and that has not changed one iota since the 1800s.

Agricultural workers after the Civil War have been entirely immigrant and migrant workers. Still are.

When they organize conservatives, especially conservative whites, get hot under the collar and call it communismsocialism yet prattle on about merit and meritocracy in overwhelmingly white and male sectors.

________________________________

The way to right wrongs is to

Shine the light of truth on them.

~ Ida B. Wells

________________________________

The way to right wrongs is to

Shine the light of truth on them.

~ Ida B. Wells

________________________________

Re: Elon Musk Income Taxes

Some years ago, I was involved in an attempt to organize Reynolds tobacco in North Carolina. Many blacks openly supported unionization from the beginning. The company almost openly race-baited in fighting the attempt, supervisors telling whites that the blacks would be running the union, and the union lost white support, and we lost.carmenjonze wrote: ↑Tue Dec 21, 2021 8:47 am Workplaces were segregated by race and gender, and entire sectors were gendered.

They still are. Domestics have always been entirely nonwhite and/or immigrant women, and that has not changed one iota since the 1800s.

Agricultural workers after the Civil War have been entirely immigrant and migrant workers. Still are.

When they organize conservatives, especially conservative whites, get hot under the collar and call it communismsocialism yet prattle on about merit and meritocracy in overwhelmingly white and male sectors.

- carmenjonze

- Posts: 9614

- Joined: Mon Oct 25, 2021 3:06 am

Re: Elon Musk Income Taxes

Really old tactic they have been pulling since the Reconstruction era.gounion wrote: ↑Tue Dec 21, 2021 8:54 am Some years ago, I was involved in an attempt to organize Reynolds tobacco in North Carolina. Many blacks openly supported unionization from the beginning. The company almost openly race-baited in fighting the attempt, supervisors telling whites that the blacks would be running the union, and the union lost white support, and we lost.

________________________________

The way to right wrongs is to

Shine the light of truth on them.

~ Ida B. Wells

________________________________

The way to right wrongs is to

Shine the light of truth on them.

~ Ida B. Wells

________________________________

- carmenjonze

- Posts: 9614

- Joined: Mon Oct 25, 2021 3:06 am

Re: Elon Musk Income Taxes

Glennfs is apparently one of those white cons who thinks only white males did any work.

So weird. I wonder how people like that think this country was even built.

So weird. I wonder how people like that think this country was even built.

________________________________

The way to right wrongs is to

Shine the light of truth on them.

~ Ida B. Wells

________________________________

The way to right wrongs is to

Shine the light of truth on them.

~ Ida B. Wells

________________________________

- carmenjonze

- Posts: 9614

- Joined: Mon Oct 25, 2021 3:06 am

Re: Elon Musk Income Taxes

Now's a good time for a reminder that the dreaded i-word, intersectionality, was originally coined in 1989 to describe how race and class impact Black working-class women, specifically. These days it's incorrectly cast as people having multiple identites at the same time, or such, but the original meaning was specific to Black working-class women.

For those who have never read any critical race theory, Kimberle Crenshaw is also a key critical race theorist.

Demarginalizing the Intersection of Race and Sex: A Black Feminist Critique of Antidiscrimination Doctrine, Feminist Theory and Antiracist Politics - University of Chicago Legal Forum, pdf

For those who have never read any critical race theory, Kimberle Crenshaw is also a key critical race theorist.

Demarginalizing the Intersection of Race and Sex: A Black Feminist Critique of Antidiscrimination Doctrine, Feminist Theory and Antiracist Politics - University of Chicago Legal Forum, pdf

Much more in link.With Black women as the starting point, it be-

comes more apparent how dominant conceptions of discrimination

condition us to think about subordination as disadvantage occur-

ring along a single categorical axis. I want to suggest further that

this single-axis framework erases Black women in the conceptual-

ization, identification and remediation of race and sex discrimina-

tion by limiting inquiry to the experiences of otherwise-privileged

members of the group. In other words, in race discrimination cases,

discrimination tends to be viewed in terms of sex- or class-privi-

leged Blacks; in sex discrimination cases, the focus is on race- and

class-privileged women.

I will center Black women in this analysis in order to contrast

the multidimensionality of Black women's experience with the sin-

gle-axis analysis that distorts these experiences. Not only will this

juxtaposition reveal how Black women are theoretically erased, it

will also illustrate how this framework imports its own theoretical

limitations that undermine efforts to broaden feminist and antiracist

analyses.

This focus on the most privileged group members marginalizes

those who are multiply-burdened and obscures claims that cannot

be understood as resulting from discrete sources of discrimination.

I suggest further that this focus on otherwise-privileged group

members creates a distorted analysis of racism and sexism because

the operative conceptions of race and sex become grounded in ex-

periences that actually represent only a subset of a much more

complex phenomenon.

________________________________

The way to right wrongs is to

Shine the light of truth on them.

~ Ida B. Wells

________________________________

The way to right wrongs is to

Shine the light of truth on them.

~ Ida B. Wells

________________________________

- carmenjonze

- Posts: 9614

- Joined: Mon Oct 25, 2021 3:06 am

Re: Elon Musk Income Taxes

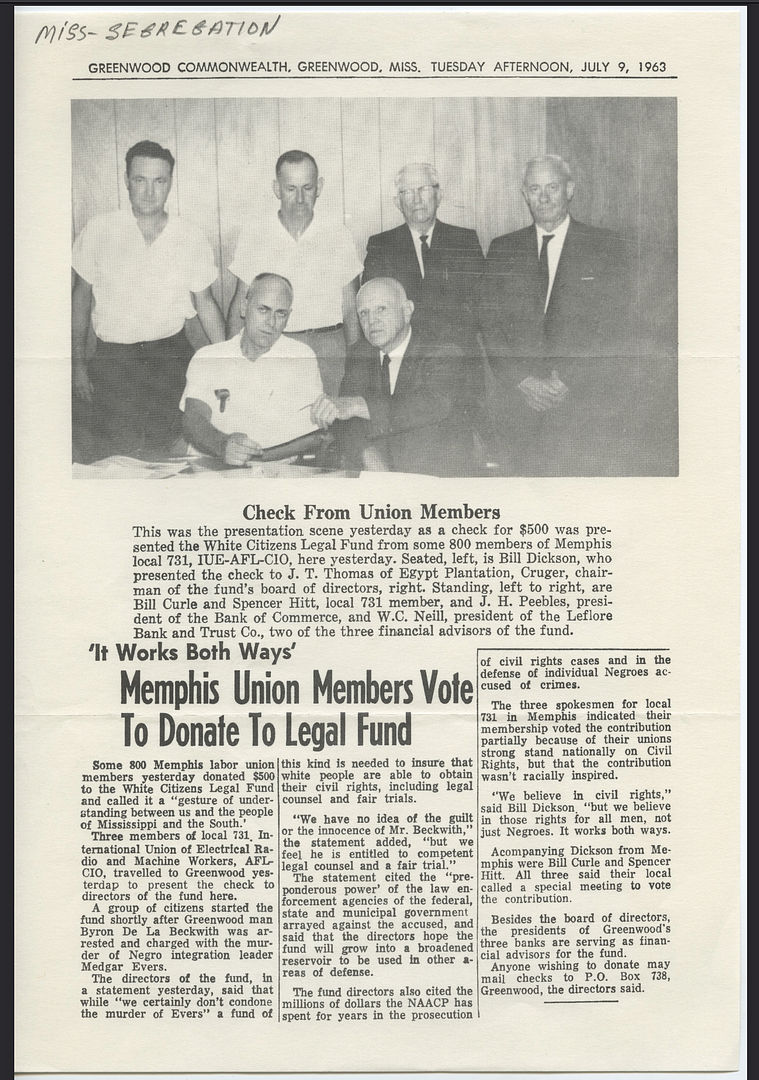

Not a good look for the Memphis AFL-CIO 1963, after the assassination of Medgar Evers.gounion wrote: ↑Tue Dec 21, 2021 8:16 am It certainly wasn't. And yes, the unions WERE segregated. Now, in Detroit, blacks did work in the auto plants, but in the dirtiest jobs. Same with the aircraft plants in Kansas.

For years, my union excluded all the white men. Period. I'm not proud of that at all. The AFL was segregated, The AFL was dedicated to craft unionism, where only skilled workers could join. The CIO was NOT, they wanted to unionize all workers, such as unskilled or semiskilled workers. My union changed to integrate, and I AM proud that that demand for change came from the grass roots.

Memphis Union Members Vote to Donate to Legal Fund - Ole Miss Libraries

For those who don't know, MLK would be assassinated in this city 5 years later while lending support and visibility to the Memphis sanitation workers' strike, in which Black workers were getting the sh#ttiest jobs and getting killed on the job due to sh#tty equipment.

________________________________

The way to right wrongs is to

Shine the light of truth on them.

~ Ida B. Wells

________________________________

The way to right wrongs is to

Shine the light of truth on them.

~ Ida B. Wells

________________________________

Re: Elon Musk Income Taxes

“ URBAN-BROOKINGS TAX POLICY CENTER

@TaxPolicyCenter

The Urban-Brookings Tax Policy Center (TPC) aims to provide independent analyses of current and longer-term tax issues and to communicate its analyses to the public and to policymakers in a timely and accessible manner. The Center combines top national experts in tax, expenditure, budget policy, and microsimulation modeling to concentrate on four overarching areas of tax policy that are critical to future debate.

TPC is a joint venture of the Urban Institute and Brookings Institution. The Center is made up of nationally recognized experts in tax, budget, and social policy who have served at the highest levels of government.

TPC provides timely, accessible analysis and facts about tax policy to policymakers, journalists, citizens, and researchers.

To read the full collection of research or find out about news and events, visit the Center’s website at: http://www.taxpolicycenter.org/“

https://www.taxpolicycenter.org/taxvox/ ... d-war-ii-0

1955 effective tax rate was sub 30% for top 1%.

@TaxPolicyCenter

The Urban-Brookings Tax Policy Center (TPC) aims to provide independent analyses of current and longer-term tax issues and to communicate its analyses to the public and to policymakers in a timely and accessible manner. The Center combines top national experts in tax, expenditure, budget policy, and microsimulation modeling to concentrate on four overarching areas of tax policy that are critical to future debate.

TPC is a joint venture of the Urban Institute and Brookings Institution. The Center is made up of nationally recognized experts in tax, budget, and social policy who have served at the highest levels of government.

TPC provides timely, accessible analysis and facts about tax policy to policymakers, journalists, citizens, and researchers.

To read the full collection of research or find out about news and events, visit the Center’s website at: http://www.taxpolicycenter.org/“

https://www.taxpolicycenter.org/taxvox/ ... d-war-ii-0

1955 effective tax rate was sub 30% for top 1%.

Re: Elon Musk Income Taxes

Not if he didn’t make any money in 2018. He cleared a billion from the previous 4 years so he doesn’t need to sell any assets. He doesn’t receive a salary or dividends. Doesn’t appear to have an extravagant lifestyle so that billion will go a long way. The reality is that from 2006-2017 he paid income taxes - $455 million for one 4 year period. Soon to pay in excess of $10 billion. Top 1% pays 40%, top 50% pay 97%. I’d say that’s progressive.

Re: Elon Musk Income Taxes

I’ve said it before - this is a false argument. If you put Mitt Romney and I together, Mitt pays nearly 100% of taxes paid. But it doesn’t change the fact that I pay a larger percentage of my income in taxes than he does.Bludogdem wrote: ↑Tue Dec 21, 2021 9:45 am Not if he didn’t make any money in 2018. He cleared a billion from the previous 4 years so he doesn’t need to sell any assets. He doesn’t receive a salary or dividends. Doesn’t appear to have an extravagant lifestyle so that billion will go a long way. The reality is that from 2006-2017 he paid income taxes - $455 million for one 4 year period. Soon to pay in excess of $10 billion. Top 1% pays 40%, top 50% pay 97%. I’d say that’s progressive.

The rich own most of the wealth in this country. Trump and Mitt stay wealthy because they use the bankruptcy laws to their advantage to shield their wealth, while they changed the laws so that the working class can no longer escape crushing debt.

Again, you getting paid to defend the wealthy or are you doing it pro bono?

- carmenjonze

- Posts: 9614

- Joined: Mon Oct 25, 2021 3:06 am

Re: Elon Musk Income Taxes

Understanding Apartheid: The Implementation of Apartheid - Apartheid Museum, pdfBludogdem wrote: ↑Tue Dec 21, 2021 9:45 am Not if he didn’t make any money in 2018. He cleared a billion from the previous 4 years so he doesn’t need to sell any assets. He doesn’t receive a salary or dividends. Doesn’t appear to have an extravagant lifestyle so that billion will go a long way. The reality is that from 2006-2017 he paid income taxes - $455 million for one 4 year period. Soon to pay in excess of $10 billion. Top 1% pays 40%, top 50% pay 97%. I’d say that’s progressive.

________________________________

The way to right wrongs is to

Shine the light of truth on them.

~ Ida B. Wells

________________________________

The way to right wrongs is to

Shine the light of truth on them.

~ Ida B. Wells

________________________________

Re: Elon Musk Income Taxes

Uh, we do know what the word "average" means. Right? Some are paying above that effective rate, some below ... yeh?Bludogdem wrote: ↑Tue Dec 21, 2021 9:38 am https://www.taxpolicycenter.org/taxvox/ ... d-war-ii-0

1955 effective tax rate was sub 30% for top 1%.

Let's go to the table from your source:

It's there to support the CONCLUSION they have in their work:

Let's go to the top:

Effective Income Tax Rates Have Fallen for The Top One Percent Since World War II

While average effective tax rates barely changed in the US from 1945 to 2015, the average tax rates of high-income households fell sharply—from about 50 percent to 25 percent for the highest income 0.01 percent and from about 40 percent to about 25 percent for the top 1 percent.

[now to the conclusion:]

But using our method, effective tax rates on high-income taxpayers are lower now than in the past.

[snip][end]

Just realize: you are using a paper they wrote to show our tax system has become less progressive to argue (let's see, somebody here has kept saying that, hmmm?) ... well, who knows WTF you're arguing at this point.

"Don't believe every quote attributed to people on the Internet" -- Abraham Lincoln

Re: Elon Musk Income Taxes

He’s arguing that the rich are overtaxed even when they don’t pay anything. And that Trump is really smart because he doesn’t pay taxes.

Or something like that.

Or something like that.

Re: Elon Musk Income Taxes

That 90% tax rate of the 50’s that idiot liberals cite is bull.ProfX wrote: ↑Tue Dec 21, 2021 9:55 am Uh, we do know what the word "average" means. Right? Some are paying above that effective rate, some below ... yeh?

Let's go to the table from your source:

It's there to support the CONCLUSION they have in their work:

Let's go to the top:

Effective Income Tax Rates Have Fallen for The Top One Percent Since World War II

While average effective tax rates barely changed in the US from 1945 to 2015, the average tax rates of high-income households fell sharply—from about 50 percent to 25 percent for the highest income 0.01 percent and from about 40 percent to about 25 percent for the top 1 percent.

[now to the conclusion:]

But using our method, effective tax rates on high-income taxpayers are lower now than in the past.

[snip][end]

Just realize: you are using a paper they wrote to show our tax system has become less progressive to argue (let's see, somebody here has kept saying that, hmmm?) ... well, who knows WTF you're arguing at this point.

And corporate tax rates have declined in the U,S. To match the decline of foreign corporate tax rates. Competition.

Re: Elon Musk Income Taxes

You pay an effective tax rate higher than 21%?gounion wrote: ↑Tue Dec 21, 2021 9:51 am I’ve said it before - this is a false argument. If you put Mitt Romney and I together, Mitt pays nearly 100% of taxes paid. But it doesn’t change the fact that I pay a larger percentage of my income in taxes than he does.

The rich own most of the wealth in this country. Trump and Mitt stay wealthy because they use the bankruptcy laws to their advantage to shield their wealth, while they changed the laws so that the working class can no longer escape crushing debt.

Again, you getting paid to defend the wealthy or are you doing it pro bono?

Re: Elon Musk Income Taxes

Greengrass has completely dropped the pretense of being a moderate. He hates liberals, always has. He can’t even pretend.

And not competition, but extortion and blackmail. “Cut our taxes, or we’re out of here”.

Re: Elon Musk Income Taxes

There were many years when I paid a higher effective rate than Romney.. Yes. I was in the “sweet spot” where people making wages paid the very most. Romany’s rate was 15% at the highest.

And I thought the rich paid a 50% effective rate? You sure do change your tune all the time, don’t you?

Re: Elon Musk Income Taxes

That it was the top marginal rate is not bull. I know, I know, statutory != effective. But the truth is, when you start talking about effective rates, they aren't set by statute. You need to guesstimate. Fact. That whole paper is because of this problem. I won't dispute it was the top marginal rate paid only by a very small number of people ... just don't call people idiots for citing that it was, really, the top statutory marginal rate.

That people then, as now, found ways to avoid it is reality.

This claim that somehow people are less good at evading statutory rates today in 2021 than in 1950 is also, bull. For one thing, as I keep saying, offshore tax havens have proliferated and are easier than ever to hide money in.

Finally, "competition" is just a buzzword. The policy decision to lower corporate tax rates was a policy choice. It's weird how some people will react with shock and horror that the U.S. might copy European social or economic policies, until it comes time to justify lowering corporate rates, and then it's suddenly "well they did it too".

That people then, as now, found ways to avoid it is reality.

This claim that somehow people are less good at evading statutory rates today in 2021 than in 1950 is also, bull. For one thing, as I keep saying, offshore tax havens have proliferated and are easier than ever to hide money in.

Finally, "competition" is just a buzzword. The policy decision to lower corporate tax rates was a policy choice. It's weird how some people will react with shock and horror that the U.S. might copy European social or economic policies, until it comes time to justify lowering corporate rates, and then it's suddenly "well they did it too".

Last edited by ProfX on Tue Dec 21, 2021 10:10 am, edited 2 times in total.

"Don't believe every quote attributed to people on the Internet" -- Abraham Lincoln

- carmenjonze

- Posts: 9614

- Joined: Mon Oct 25, 2021 3:06 am

Re: Elon Musk Income Taxes

blood and soil

________________________________

The way to right wrongs is to

Shine the light of truth on them.

~ Ida B. Wells

________________________________

The way to right wrongs is to

Shine the light of truth on them.

~ Ida B. Wells

________________________________

Re: Elon Musk Income Taxes

Say I'm a high-paid wage guy - like the head of engineering at some firm. I don't like to fly commercial, so I want to buy an airplane. So, I buy a twin-engine Beechcraft. It's pricey, but I can afford it. I pay for that with my AFTER-tax money. I pay my income taxes up front, deducted from my paycheck. I don't have any way to hide my money.ProfX wrote: ↑Tue Dec 21, 2021 10:03 am That it was the top marginal rate is not bull. I know, I know, statutory != effective. But the truth is, when you start talking about effective rates, they aren't set by statute. You need to guesstimate. Fact. That whole paper is because of this problem. I won't dispute it was the top marginal rate paid only by a very small number of people ... just don't call people idiots for citing that it was, really, the top statutory marginal rate.

That people then, as now, found ways to avoid it is reality.

This claim that somehow people are less good at evading statutory rates today in 2021 than in 1950 is also, bull. For one thing, as I keep saying, offshore tax havens have proliferated and are easier than ever to hide money in.

But if a rich guy like Musk doesn't want to fly commercial, why, he just has Tesla buy a Gulfstream, and it's all a deductible business expense.

Does Musk want to play golf in some fancy resort? Well, just arrange a "conference" there, and THAT'S all a business expense, too!

If I want to play golf at a fancy resort, I pay the whole bill out of after-tax money.

And I guess bluedog WANTS to be able to do the things that Musk does, so he sure doesn't want the system changed!

Re: Elon Musk Income Taxes

Cons like him hate us more than the minorities they seek to enslave.

I sigh in your general direction.

- carmenjonze

- Posts: 9614

- Joined: Mon Oct 25, 2021 3:06 am

Re: Elon Musk Income Taxes

?

________________________________

The way to right wrongs is to

Shine the light of truth on them.

~ Ida B. Wells

________________________________

The way to right wrongs is to

Shine the light of truth on them.

~ Ida B. Wells

________________________________